Swift EMI Calculator

EMI Result

Please adjust the sliders or enter values and click 'Calculate EMI'.

The Maruti Suzuki Swift is one of the most popular hatchbacks in India, known for its stylish design, fuel efficiency, and reliable performance. If you’re considering purchasing a Swift, understanding the financial implications is essential. A Swift EMI Calculator is a valuable tool that helps you estimate the monthly payments you’ll need to make if you finance your purchase with a car loan.

Maruti Suzuki Swift Overview

| Feature | Details |

| Engine | 1.2-liter K-Series Dual Jet Dual VVT Petrol Engine |

| Power Output | 89 BHP |

| Torque | 113 Nm |

| Transmission Options | 22-24 km/l (approx.) |

| Design Highlights | Bold front grille, LED projector headlamps, stylish alloy wheels |

| Infotainment | Smart Play Studio infotainment system |

| Comfort Features | Keyless entry, push-button start, automatic climate control |

| Safety Features | Dual airbags, ABS with EBD, rear parking sensors |

| Price Range | ₹5.99 lakhs to ₹8.98 lakhs (ex-showroom) |

What is a Swift EMI Calculator?

A Swift EMI Calculator is an online tool that helps you calculate the Equated Monthly Installment (EMI) you need to pay if you take a loan to purchase the Maruti Suzuki Swift. It factors in the loan amount, interest rate, and loan tenure to provide an accurate estimate of your monthly financial obligations.

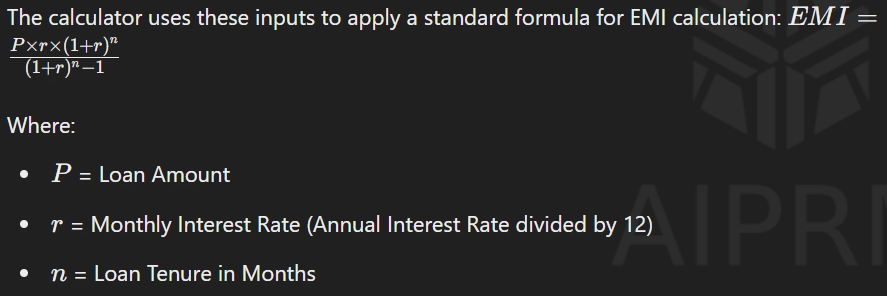

How Does the Swift EMI Calculator Work?

The Swift EMI Calculator uses the following inputs:

- Loan Amount: This is the amount you wish to borrow from the bank or financial institution. It is typically the on-road price of the Swift minus any down payment you make.

- Interest Rate: This is the interest rate charged by the lender on the loan amount. Interest rates can vary based on the bank, your credit score, and the prevailing market conditions.

- Loan Tenure: The period over which you intend to repay the loan. The tenure can range from 12 months to 60 months or more.

the calculator computes your EMI, giving you a clear picture of what your monthly payments will look like.

Benefits of Using the Swift EMI Calculator

- Accurate Financial Planning: The Swift EMI Calculator helps you understand your monthly financial commitments, allowing you to plan your budget effectively.

- Loan Comparison: By adjusting the interest rate and loan tenure, you can compare different loan offers from various banks, helping you choose the most favorable option.

- Instant Results: The calculator provides quick results, saving you time and effort. You can easily experiment with different loan scenarios to find the best fit for your financial situation.

- Transparency: The EMI Calculator gives you a breakdown of your monthly payments, including both principal and interest components, ensuring there are no hidden costs.

How to Use the Swift EMI Calculator

Using the Swift EMI Calculator is simple:

- Enter the Loan Amount: Input the total amount you plan to borrow for the Swift.

- Input the Interest Rate: Enter the interest rate offered by the lender. You can try different rates to compare loan options.

- Select the Loan Tenure: Choose the period over which you want to repay the loan.

- Get Your EMI: The calculator will instantly display your monthly EMI, total interest payable, and the overall cost of the loan.

Conclusion

Purchasing a Maruti Suzuki Swift is a smart choice for those seeking a reliable, stylish, and fuel-efficient vehicle. However, it’s important to plan your finances carefully. The Swift EMI Calculator is an excellent tool to help you estimate your monthly payments and choose the best loan option. By understanding your EMI and planning your budget, you can enjoy the thrill of driving your new Swift without worrying about financial strain.

Whether you’re a first-time car buyer or upgrading to a new Swift, using the Swift EMI Calculator will ensure you’re fully prepared for your financial journey.

- You can also calculate the EMI of your Maruti Suzuki Baleno by Clicking Here

“Such a refreshing read! 💯 Your thorough approach and expert insights have made this topic so much clearer. Thank you for putting together such a comprehensive guide.”